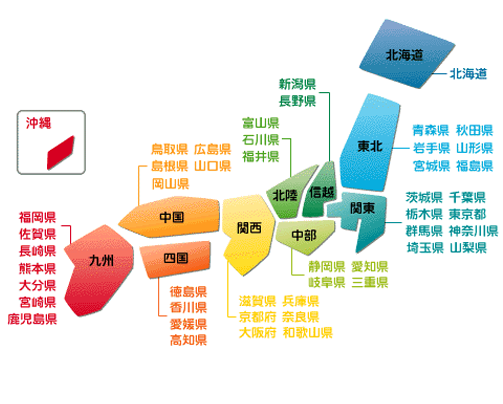

Dispatch throughout Japan

1.The export process flow:

Pick-up →Warehousing-in→weighting→sorting→ prerecord→packaging→Warehousing-out→Customs declaration→flight→Customs clearance→delivery→signed

2.Japanese terrain

3.Japanese line exportation declaration

(一)China Express export customs clearance classification: A, B, C, D four categories

Category A: Documents, documents, documents and bills of no commercial value that are exempt from tax under the current customs regulations.

Category B: Items exempt if exempted within the current customs regulations (400 RMB).

Category C: Taxable items that exceed the limits set by the current customs regulations but do not exceed RMB 5000 (goods restricted by laws and administrative regulations of the People's Republic of China and commodities subject to quota management are not included)。

D:Items other than the first three categories

(TWO)China Export Express Clearance Requirements:

A: Customers do not need to provide documents for customs clearance;

B、C: Customers are required to provide customs clearance invoices for customs clearance;

D类: Customers need to provide import and export formal customs clearance documents for customs clearance.

4.China import express declaration

• Classification of China's import express customs clearance methods:

• KJ1、KJ2、KJ3、D

• KJ1:Documents, documents, documents and bills of no commercial value that are exempt from tax under the existing customs regulations.

• KJ2:The existing customs regulations limit (400 yuan) of duty-free goods.

• KJ3:The CIF price of imported express goods is between RMB400 and RMB 5000, and the trade act belongs to the goods of free giveaways and samples provided by foreign countries (the laws and administrative regulations of the People's Republic of China restrict the import and export of goods, quota management goods are not included).

• D:Items other than the first three categories.

• KJ1: Customers do not need to provide documents for customs clearance;

• KJ2/KJ3:Customers need to provide customs clearance invoices for customs clearance;

• D: Customers need to provide import declaration power of attorney, invoices, packing slips for customs clearance.

5.Japanese customs clearance process

1. DOC Clearance (Documents)

2. SP Customs clearance (Declared value of less than 10000 yen and weight of less than 20KG of goods, except in exceptional circumstances)

3.General customs clearance: (declared value of more than 10000 yen, or weight of 20KG or more of goods, except in exceptional circumstances)

• Customs requirements must be generally cleared:

• ①20KG or more (invoice required, general customs clearance)

• ②Leather products Knitwear, shoes, other consignments, food, medical items and other laws and regulations

(Invoices required and general customs clearance),Some products also need the medicine matter law、

• ③Claims worth more than 10,000 yen (invoices required, general customs clearance required)

• Medical equipment and health care goods, Japan must provide pharmaceutical affairs law

• Goods in contact with food need to be issued by Japan's Ministry of Health and Welfare of food import license

Some goods are certified as having a certificate of origin and can import Japanese goods duty-free, timely notification to CML

The japanese domestic delivery

• There are several ways to deliver a express

TA-Q-BIN(single piece weight within 30KG, the sum of the three sides is less than 180CM)

Mixed delivery(Single piece weight of more than 30KG, or the sum of the three sides is greater than 180CM less than 200CM)

Special Car delivery(Flexible and diversified value-added services at the request of guests)

Special delivery(Flexible and diversified value-added services at the request of guests)

6.Osaka, Tokyo 23 areas to the region today (see attachment)

7.Notes on customs invoices

• One, unified requirements:

• The sender and recipient information must be complete:

• Include: A: mail, name of the recipient

• B:Sender, the recipient company name

• C:Sender and Recipient addresses.

• D:Sender and Recipient Contact Phone

• E:Recipient zip code

• Specific product names must be detailed:

• A:Number of pieces (cases)(One ticket of several pieces of goods, several pieces for a few boxes)

• ☆B:Description of the goods (detailed name)

• C:Number of goods (specific quantity)

• D:Units of quantity(packages<PCS>)

• E:Unit price (in minimum units)

• F:Total price (unit price x quantity)

• Sender's signature or company seal

• Date of shipment

• Must be printed electronic invoices, such as special circumstances can only be handwritten invoices must be clear, can not be altered

• TWO、Special requirements

• 1、Tokyo Special Requirements:

• Focus: Declared Value

• 1)Textiles:

• A:Clothing: Please be sure to indicate on the invoice clothing a: ingredients (the proportion of each component);b:Weaving: knitting or weaving;c:Types of styles;d:Men's (women, children);e:Types of clothing (coats, T'shirts, etc.)

• Example: Wrong description: Coat

• Correct description: cotton women's coat (knitted) On receipt:LADIE’S 100% COTTON KNIT COAT

•or (KNIT)、(WOVEN)It is also possible to mark separately in parentheses at the end of the description.

• If it is underwear, it should be indicated what kind of underwear, and finally in parentheses.

• 2)Accessories:

• Fabric to indicate: the width of the fabric (door frame), length, material.

• Note: All textile goods must be filled in: knitting way: knitting, weaving

• Ingredients: cotton, polyester, etc.

• 3)Machine accessories category:

• a:If it is a mechanical accessory, the name and material of the main machine must be written in the parenthesis at the back.

• b:The tariffs generated to confirm whether it is a semi-finished or finished product are different.

• 4)Decorations:

• Write clearly what the decorations are plus the material and whether they are painted in any color (the ratio of each component)。

• 5)Package class:

Be sure to confirm the shape of the material and bag: bag, backpack, bag, etc. Materials: PU, leather, plastic, etc.

• 2、Osaka Special Requirements:

• Key: Commodity name description

• 1)Textiles:

• A:Clothing: Please be sure to indicate on the invoice clothing a: ingredients (the proportion of each component);b:Weaving: knitting or weaving;c:Style type:d: men's (women,);e:Types of clothing (coats, T'shirts, etc.)

• Example: Wrong description: Coat

•Correct description: cotton women's coat (knitted) On the invoice:LADIE’S 100% COTTON KNIT COAT

• (KNIT)、(WOVEN)It is also possible to mark separately in parentheses at the end of the description.

• B:hosiery:

• Knitwear whether it is a dress or color card, small cloth samples must provide a face sheet and invoice for general customs clearance.

• Usually textiles are woven mainly in the form of knitting and shuttle needles

• The two in Japan customs claim suing different way, knitting must be as a general customs clearance to claim, weaving as SP cargo to claim.

• Note: Not to forge knitwear into a shuttle needle products to claim, once found out, the Japanese customs will be blacklisted, resulting in the customer will be delayed in the future clearance, but also seriously affect our reputation in the customs.

• 2)Accessories:

• In the case of large rolls of cloth shipped, the invoice needs to be noted:a: Cotton material ingredient; b: Length (meter number), width (gate);

• c:Weight per square;d:Weaving (knitting, weaving);e:Whether there is dyeing, if the stained cloth please provide is pre-dyed or post-dyed.

• 3)Bag class:

• The types of bags should be identified, e.g. handbags, briefcases, backpacks, bags and materials

• Bags: be sure to indicate the material of the bag, according to the material to determine the declared value

• 4)Industrial accessories and machine parts:

• Example: Accessories: Be sure to specify: name, use, material

• Error: TV accessories

• Correct: Stand on TV, iron

•5)Declaration in personal name:

• If the recipient is an individual must be the recipient's full name, domicile address, contact information, indicated on the invoice.

• 6)Famous brand shipment:

• If it is the famous brand shipped things must have the relevant authorization, each time with the invoice attached, available copies.

• 7)reprocessed products:

• 。

• 8)No commercial value:

• Whether it is documentation, color cards, tags and so on no (less) commercial value of things, in the case of the need to provide invoices must have the corresponding value, the price can be low, but can not be no commercial value (not zero value)。

• 9)Declared value:

• Clothing category: The declared value of each dress is generally not less than 2 dollars.

•

• Shoes: The declared value of each pair must not be less than US$4 (the material of the shoe's upper and sole must be indicated on the invoice)

• Supplementary material class

• Package category: the declared value must not be less than 4 dollars (specifically according to the material of the package to declare)

• Industrial accessories: Declared based on the actual value of the item.

• 三、matters need attention:

• 1)If the customer's collection address does not match the importer, the details of the recipient and the importer must be displayed on the invoice, and the method of payment of the tax on the consignee must be checked as "Importer".

• 2)Detailed product names and proper declared value are necessary for all customs clearance.

• 3)The invoice provided at the first time must be accurate and will be difficult to change once handed over to Customs, and if changes are required, the customs clearance of the goods will be delayed and affect the credibility of the company.

• 4)Only English or Japanese can be used on the invoice.